From 1 January 2025, many Australian businesses and financial institutions will be required to report annually on climate-related risks and opportunities under new mandatory disclosure laws. These reforms, aligned with the Australian Sustainability Reporting Standards (ASRS), aim to improve transparency, comparability, and accountability in climate reporting. Over a three-year phase-in period, the legislation will help organisations better understand and manage climate-related financial impacts—ensuring Australia remains competitive as global sustainability expectations evolve.

The recent re-election of the Labor government has solidified mandatory climate-related disclosures in Australian law, making any reversal unlikely without parliamentary action. With bipartisan support for the transition to a low-carbon economy and a government committed to climate accountability, these requirements are expected to remain in place—and potentially strengthen—over the coming years. Businesses should view this as a clear signal to prepare, as reporting obligations will apply to many entities from this year onwards.

Furthermore, despite predictions that other global geopolitical entities may reduce their environmental diligence, Australia is unlikely to be influenced by this stance. Both the UK and the EU have implemented stringent mandatory disclosure programs aligned with international frameworks such as the Task Force on Climate-related Financial Disclosures (TCFD) and Global Reporting Initiative (GRI), aiming to enhance transparency and accountability in managing climate-related risks and opportunities. In the EU's case, these measures also promote transparency and comparability across its internal member states.

Closer to home, several countries in the Asia-Pacific region are moving towards mandatory climate-related disclosures to manage climate risks. For instance, Singapore will implement mandatory climate reporting for listed and large non-listed companies this year (2025), aligning with the International Sustainability Standards Board (ISSB) standards. Other countries in the Asia-Pacific region such as New Zealand, Japan, Hong Kong, Sri Lanka and Pakistan are also adopting or planning to adopt similar regulations.

Our largest trading partner, China, has enforced climate disclosures since 2024. The Ministry of Ecology and Environment (MEE) requires large and medium-sized firms, particularly in high-emission sectors like power and heavy industry, to disclose their emissions. Listed companies must also adhere to the disclosure policies of their respective stock exchanges, with global investors increasingly demanding transparency on climate-related risks, pushing Chinese companies to improve their disclosure practices to meet international standards.

This global shift from voluntary to mandatory disclosures is driven by the need for consistent, comparable and transparent information on climate-related risks and opportunities across geographies. Consequently, major economies are increasingly prioritising sustainable products when selecting trade partners. For a primary production-based economy like Australia, aligning with the highest international standards is essential to maintaining competitiveness in global markets. .

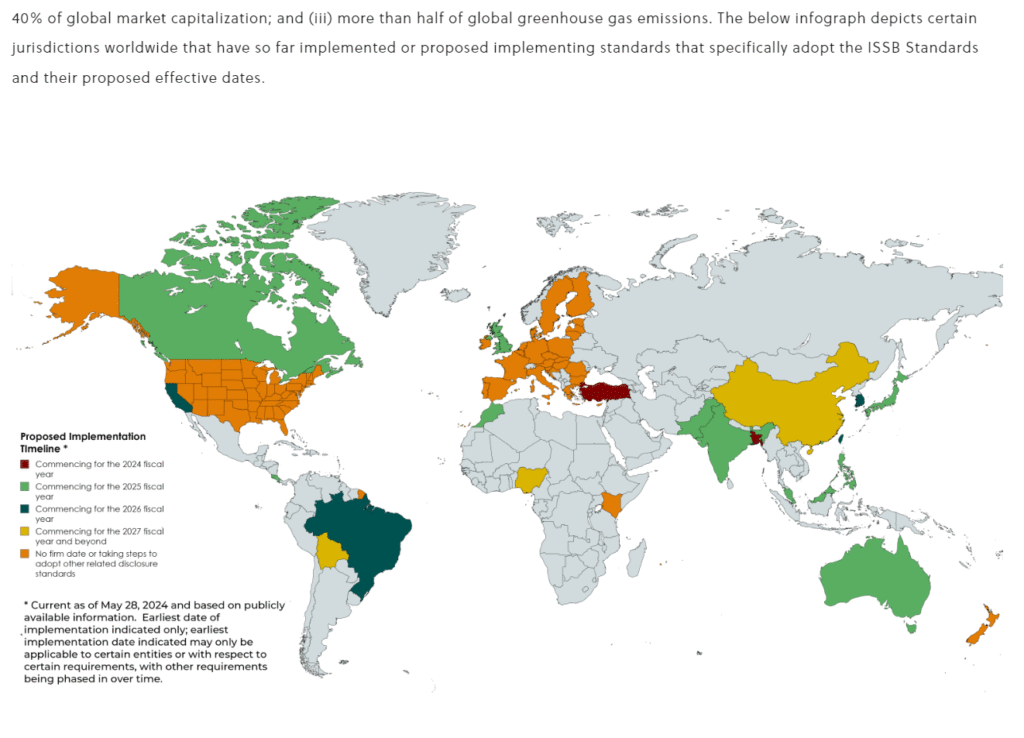

Figure 1: World map of countries aligning to ISSB[1]

While many businesses may not fall into the first phase of mandatory reporting that has already begun in 2025, it is important to understand that the transition to sustainability reporting under Australian Sustainability Reporting Standards (ASRS) will happen quickly and impact a broad range of organisations by 2026 and 2027. For many, especially those in the agricultural, property, and infrastructure sectors, this may represent a first formal foray into climate-related disclosures—and the learning curve can be steep.

Mandatory climate reporting introduces new data management, governance and strategic requirements. Businesses will need to collect and validate emissions data, develop climate risk scenarios, assess financial implications, and set forward looking decarbonisation strategies. These tasks may require input from multiple teams across finance, operations, risk management, legal and potentially external stakeholders.

In practical terms, this means additional internal resources will be needed to gather, analyse, and verify climate-related data—particularly if your business has complex operations or spans multiple regions. It also means that existing financial and risk reporting systems will need to be enhanced or upgraded to support integration with climate reporting frameworks.

If your business isn't caught in the initial phases (Group 1 & Group 2) the upside to preparing some level of disclosure, even if you aren’t required to, is significant. Acting now gives you the opportunity to enhance your access to capital, and strengthen your credibility with regulators, investors, and customers. Businesses that begin preparing today will be in a far stronger position to meet regulatory timelines, respond to investor expectations, and embed sustainability into their long-term strategy.

We recognise the need for specialised, practical, and tailored sustainability strategies that reflect the realities of your business. Our team brings deep technical expertise in AASB S2 climate-related financial disclosures.

We support our clients through the end-to-end preparation and development of audit-readiness AASB S2 aligned climate reports.

Choosing the right partner for your climate reporting obligations is critical. Let us help you streamline the process, enhance your compliance posture, and deliver reporting that adds strategic value to your business.

Our experienced team is prepared to support you on your sustainability journey. Contact us today to discuss how we can help you stay ahead of the market and enhance the value of your assets, both now and in the future.