Your Market Update - Summary

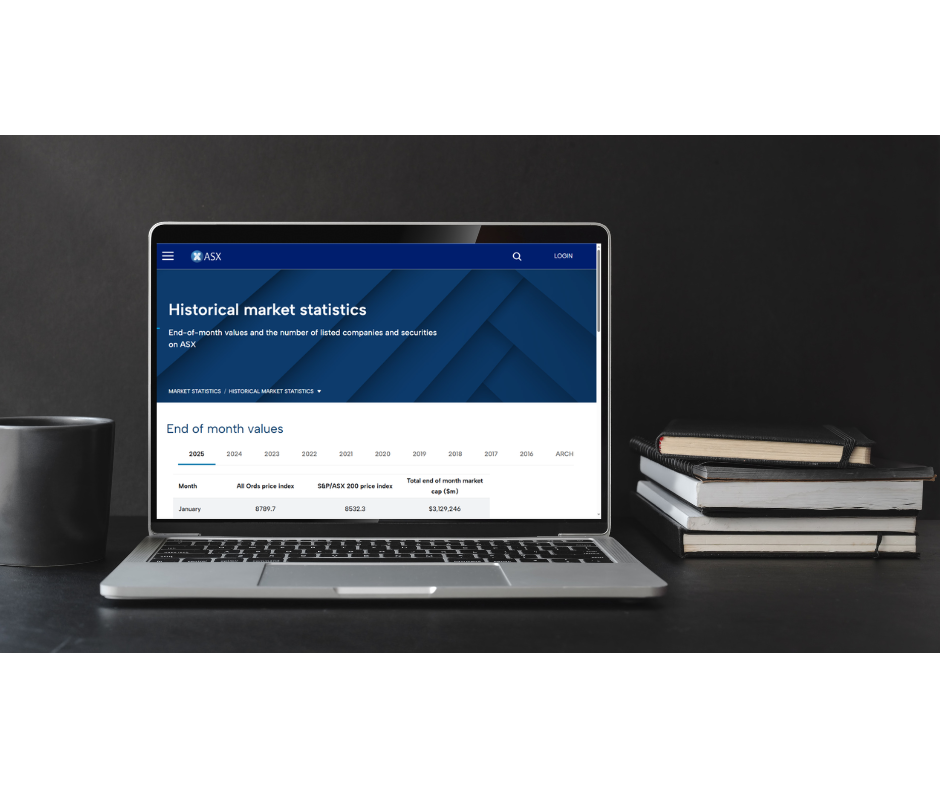

The ASX 200 got off to a strong start in 2025. With the market giving a 95% chance of the RBA lowering rates in February, returns in January were broad and deep. The ASX 200 Accumulation Index gained 4.6% for the month, hitting an all-time high of 8,566.9 points on January 31st, marking the best month for the Index since December 2023.

Ten of the eleven sectors returned gains over the month, led by Consumer Discretionary (+7.1%) and Financials (+6.1%). Other strong performers included Property (+4.7%), Information Technology (+4.2%), and Materials (+4.0%). The only sector with negative returns was Utilities, which finished down 2.4%.

The market’s hopes for an interest rate cut from the Reserve Bank of Australia (RBA) increased due to progress on inflation and a narrowing of inflationary pressures. This optimism helped Consumer Discretionary stocks bounce, as expectations of increased expenditure on non-essential items heightened. Financials also benefited from the rate-cut expectation, under the assumption of increased lending and interest income. All the “Big 4” Banks gained strongly, while they all expect a cut in interest rates at the February RBA meeting.

2025 opened on a tumultuous note, with investors reacting to executive orders from US President Donald Trump in his first days back in power, a Middle East ceasefire and disruption from Chinese AI company DeepSeek.

Nonetheless, equity markets made a solid start, with Developed Markets outperforming Emerging Markets in January, driven by positive earnings surprises, central bank support and easing inflation. Developed Markets gained 2.74% (MSCI World ExAustralia Index (AUD)) versus a 1.04% return (MSCI Emerging Markets Index (AUD)).

US markets posted solid gains, with the S&P500 rising 2.8% and the Nasdaq Composite up 1.7% (in local currency terms). Cooling core inflation and strong earnings, especially in financials and consumer discretionary sectors, lifted sentiment. However, volatility emerged as the Trump administration announced new tariffs on imports from Mexico, Canada and China, with uncertainty lingering as negotiations over their implementation continue. Meanwhile, DeepSeek’s low-cost AI model triggered the largest single day sell-off in US stock market history, wiping $589 billion off Nvidia’s market value.

Europe led global markets, with the MSCI Europe ex UK Index up 7.1%, driven by gains in financials, consumer discretionary and technology stocks. Earnings upgrades and the European Central Bank’s 25 basis point rate cut supported sentiment. In the UK, the FTSE 100 rose 5.5%, benefiting from a weak sterling that boosted overseas revenues.

Japanese equities underperformed, with the Nikkei 225 declining -0.8% (in local currency terms), weighed down by a stronger yen, US tariff concerns and the Bank of Japan’s third 25 basis point hike in interest rates. The export-heavy economy continued to face headwinds amid global trade uncertainty.

Emerging Markets posted modest returns, with the MSCI Emerging Markets Index (AUD) up 1.04%. Chinese equities lagged, with the CSI 300 Index up 0.64% and the Hang Seng Index rising 1.2% (in local currency terms), held back by weak PMI data and geopolitical concerns. Latin America was the standout performer, with the MSCI LatAm Index rising 7.6%, driven by strong investor inflows into Brazil and Chile amid currency appreciation.

Bond markets experienced notable volatility in January, though overall movements were relatively modest by month-end. In the US, the 10-year Treasury yield ended the month down slightly (-2bps) at 4.55%, though this masked significant intra-month swings with the 10-year having spiked to 4.79% on stronger economic data, including the highest non-farm payrolls report in nine months, before retracing.

In Australia, government bond yields rose by 6bps to 4.43% with soft domestic data limiting the move higher somewhat. The market started to price in a February rate cut by the RBA leading to a steeper yield curve. Looking ahead, market sentiment remains sensitive to central bank guidance and incoming economic data.

The S&P/ASX 200 A-REIT Accumulation Index TR started the year off strong, finishing up 4.65% for January. Over the previous 12 months the index is up 22.41%. Global real estate equities also moved higher, increasing by 1.47% (represented by the FTSE EPRA/NAREIT Developed Ex Australia Index (AUD Hedged)). Australian infrastructure increased with a return of 1.19%.

The Australian residential property market experienced a flat month with no change in values Month on Month for January (as represented by CoreLogic’s five capital city aggregate). Adelaide valuations continued to rise (+0.7%), followed by Darwin (+0.6%). In contrast, Melbourne was the worst performer and continued to experience a fall in value (-0.6%) alongside Sydney (- 0.4%), and Canberra (-0.5%). Perth’s notably strong performance began to slow in January, rising (+0.4%).